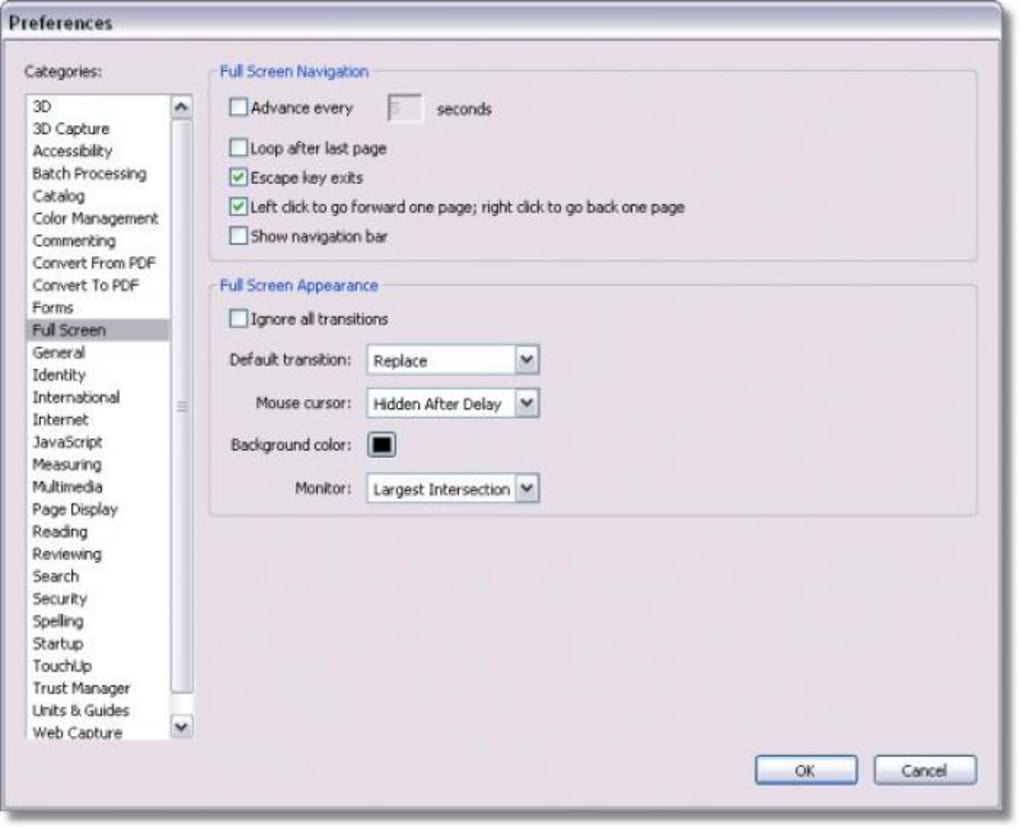

To view these documents you may need Adobe Acrobat. Before making any decision in relation to a Savings Maximiser or Orange Everyday, you should read the Savings Maximiser Terms and Conditions booklet and the Orange Everyday Terms and Conditions booklet and Orange Everyday Fees and Limits Schedule. The additional variable rate is not payable in conjunction with any other promotional rate.Īny advice on this website does not take into account your objectives, financial situation or needs and you should consider whether it is appropriate for you. ING can change or withdraw the additional variable rate at any time. If you do not satisfy the conditions to receive the additional variable rate, the standard variable rate applies.

If no nomination is made, the additional variable rate (where eligible) will be applied to an account nominated by ING at its sole discretion.Īny amounts above $100,000 are subject to the Savings Maximiser standard variable rate applicable at the time. You can check and change your nominated Savings Maximiser account via online banking or the ING mobile app. When we assess whether you've met this balance growth requirement, interest earned in the current month is not taken into account.Įach customer can nominate a maximum of one Savings Maximiser account (either single or joint) to receive the additional variable rate (where eligible). ensure that the balance of your nominated Savings Maximiser account at the end of the current month is higher than it was at the end of the previous month.

also make at least 5 card purchases that are settled (and not at a 'pending status') using your ING debit or credit card (excluding ATM withdrawals, balance enquiries, cash advances and EFTPOS cash out only transactions), and.deposit at least $1,000 from an external source to any personal ING account in your name (excluding Living Super, Personal Loans and Orange One),.

The additional variable rate (that is added to the Savings Maximiser standard variable rate) applies on one nominated Savings Maximiser per customer for the next calendar month when you also hold an Orange Everyday account and in the current calendar month you do the following: Information and interest rates are current as at the date of publication and are subject to change.

0 kommentar(er)

0 kommentar(er)